As the Income Tax Return (ITR) filing deadline of 16 September passed months ago, most taxpayers have already received their refunds. Yet a significant number still find themselves waiting, wondering why their refunds are delayed and whether any action is required from their side. While the Income Tax Department has processed the majority of returns, pending cases are mostly tied to verification issues, mismatched details, or incorrect claims.

- How Long Does It Generally Take to Receive an ITR Refund?

- How to Check Your ITR Refund Status Online

- Most Common Reasons Behind ITR Refund Delay

- Incorrect Bank Account Details

- Aadhaar–PAN Linking Issues

- Incorrect Claims or Inflated Refund Requests

- Mismatched Information in Form 26AS, AIS, or Form 16

- Pending E-Verification

- Additional Scrutiny by the IT Department

- What You Should Do If Your ITR Refund Is Still Pending

- The Paradox of Financial Security and ITR Delay

- Understanding the Real, Everlasting Refund

- The Way to Permanent Peace

If you are among those experiencing an ITR refund delay, this guide breaks down everything you need to know — what causes delays, how long the refund typically takes, and the exact steps to check your refund status.

How Long Does It Generally Take to Receive an ITR Refund?

Once a taxpayer files the return and completes e-verification, the Income Tax Department begins processing it. Under normal circumstances, the refund is deposited within 4–5 weeks from the date of successful verification.

The department has clarified that this duration may vary if discrepancies arise during assessment. Sometimes, a taxpayer with a pre-validated bank account may receive updates or refunds more quickly.

If a refund does not arrive within the expected timeframe, the department usually sends an intimation or alert to the registered email ID about possible mismatches that need correction. Taxpayers should keep an eye on their inboxes and ensure that their return does not require additional documentation or clarification.

How to Check Your ITR Refund Status Online

The most common question by the taxpayer is – “How can I check my ITR refund status?”

Here is a simple, step-by-step guide:

Step 1: Visit the official Income Tax Portal at

eportal.incometax.gov.in

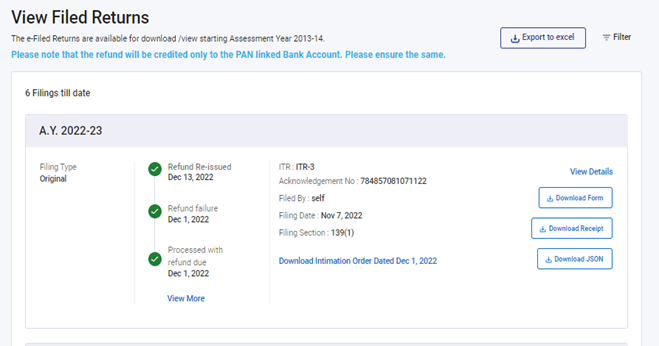

(Image Credits: Incometax.gov.in)

Step 2: Log into your account using your PAN (as user ID) and password.

(Image Credits: Incometax.gov.in)

Step 3: Go to the ‘e-File’ tab.

(Image Credits: Incometax.gov.in)

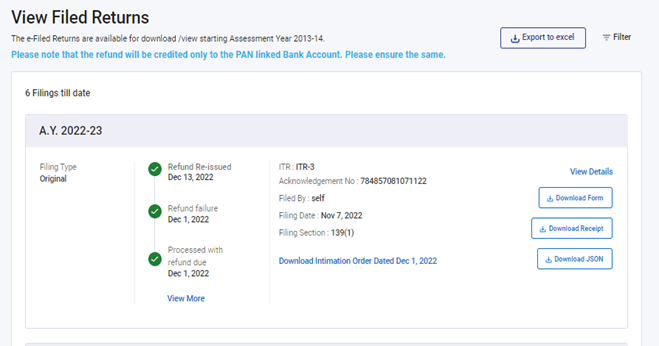

Step 4: Select ‘Income Tax Returns’, then click ‘View Filed Returns’.

Step 5: Your filed ITRs (current and previous years) will appear on the screen.

Step 6: Click on ‘View Details’ to check the real-time status of your refund.

(Image Credits: Incometax.gov.in)

This section will show whether your refund has been processed, is under review, has been credited, or requires action from your side.

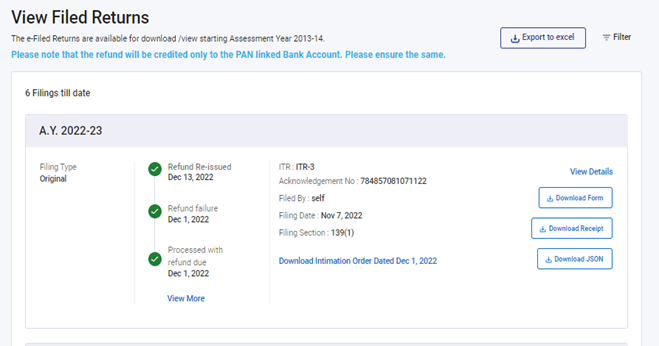

4 Possible Cases of ITR Refund Status

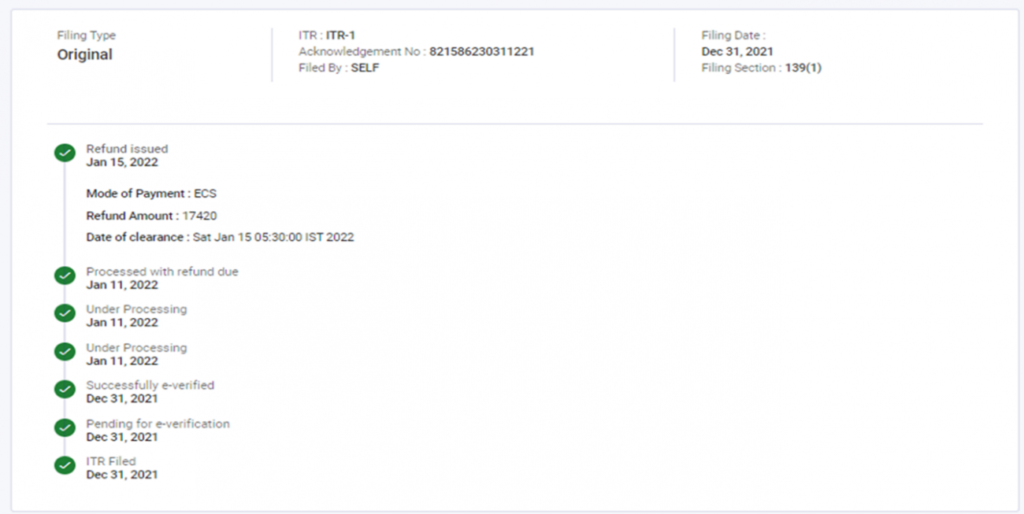

Case 1: Refund Issued:

(Image Credits: Incometax.gov.in)

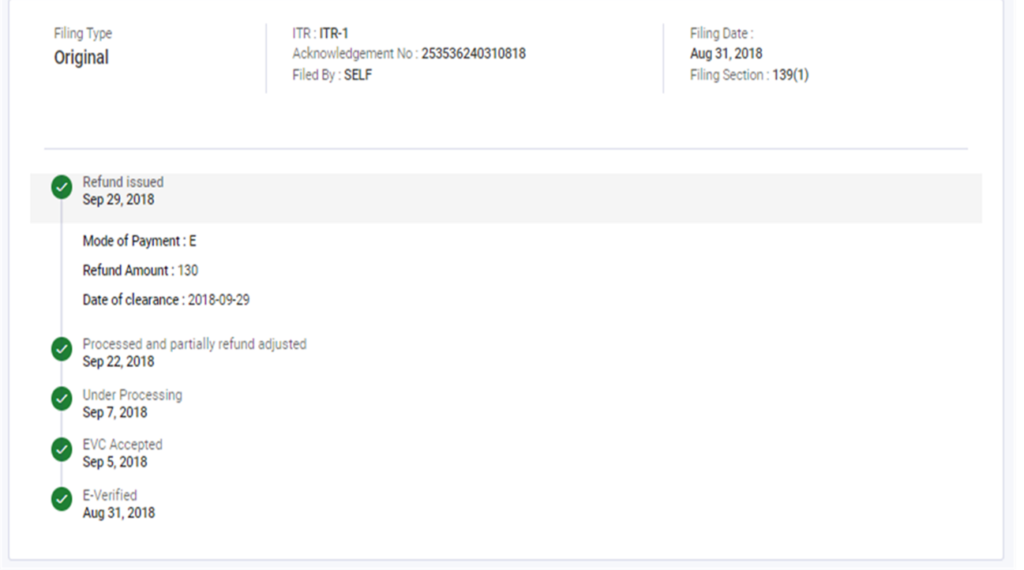

Case 2: Partial Adjustment of Refund

(Image Credits: Incometax.gov.in)

Case 3: Full Adjustment of Refund

(Image Credits: Incometax.gov.in)

Case 4: Refund Failure

(Image Credits: Incometax.gov.in)

Also Read: New Income Tax Bill 2025: लोकसभा से पास, 60 साल पुराने कानून में ऐतिहासिक बदलाव

Most Common Reasons Behind ITR Refund Delay

Several technical or data-related issues can hold up the refund process. Here are the most frequent causes:

Incorrect Bank Account Details

Usually, refunds are credited into your bank account linked to your ITR. Even a minor error — wrong account number or incorrect IFSC code — can block the refund.

Taxpayers must ensure:

- The bank account is active,

- Correct details are entered, and

- The account is pre-validated on the portal.

Any recent change in bank details may also cause temporary delays until the updated information is verified.

Aadhaar–PAN Linking Issues

A mismatch between Aadhaar and PAN details can significantly slow down the ITR processing. Name mismatches, outdated Aadhaar information, or incomplete linking can trigger verification alerts.

Since Aadhaar-PAN linkage is now mandatory for filing ITRs, taxpayers must ensure both databases reflect the same personal details. While checking your ITR Refund Status, you will see a message pop-up to link Aadhaar card and PAN card.

(Image Credits: Incometax.gov.in)

Incorrect Claims or Inflated Refund Requests

If a taxpayer claims deductions, exemptions, or credits without adequate supporting documentation, the Income Tax Department may pause the refund until verification is complete.

Overstated or false claims often result in:

- A notice being issued

- Requests for additional documents

- Manual scrutiny of the return

This can drastically increase the refund processing time.

Mismatched Information in Form 26AS, AIS, or Form 16

The department compares reported income with official data sources like:

- Form 26AS

- Annual Information Statement (AIS)

- Form 16

Any mismatch — such as wrong TDS entries, unreported income, or differences in interest income — may lead to a processing delay. Refunds are issued only after discrepancies are clarified.

Pending E-Verification

The Income Tax Department does not start processing refunds until the taxpayer completes e-verification.

If the return is submitted but not e-verified, the refund will remain on hold indefinitely.

Methods to e-verify include:

- Aadhaar OTP

- Net banking

- Digital signature certificate

- Bank account or demat account verification

Taxpayers should ensure e-verification is completed immediately after filing.

Additional Scrutiny by the IT Department

In some cases, the system flags certain returns for deeper scrutiny. This usually happens when:

- Income patterns change sharply compared to previous years

- High-value transactions appear in AIS

- Claimed refunds exceed expected norms

Such returns undergo detailed verification, naturally leading to delays.

What You Should Do If Your ITR Refund Is Still Pending

If more than 5 weeks have passed since e-verification, follow these steps:

- Check the income tax portal once again to know your refund status.

- Review emails or SMS alerts for discrepancies or notices.

- Correct errors related to bank details, Aadhaar-PAN linking, or mismatched data.

- Submit any required documents promptly.

- If necessary, raise a grievance through the “e-Nivaran” section on the portal of income tax india e fillings.

Most issues can be resolved with timely action and accurate information. Taxpayers are stressed and posting about ITR refund delays on the social media platform ‘X’.

The Paradox of Financial Security and ITR Delay

For most people, financial stability feels like real security. Filing an Income Tax Return (ITR) is a routine part of this system, and even a small delay in receiving a refund can cause worry. It affects budgets, day-to-day planning, and peace of mind. But this simple delay also makes us think: if a minor issue in a man-made system can disturb us so much, how much control do we actually have over our life’s security? We depend heavily on outside systems for comfort, while ignoring the spiritual side that truly shapes our future.

Understanding the Real, Everlasting Refund

According to Jagatguru Tatvdarshi Sant Rampal Ji Maharaj, everything we gain or lose in this world is part of the give-and-take of Kaal Brahm’s mortal world. Our biggest burden is not financial — it is the load of our past karmas. These karmas are responsible for the struggles, illnesses, and hardships we face in life.

While we stay busy worrying about a temporary government refund, we forget about the huge spiritual debt that keeps us tied to the cycle of birth and death. Real safety and peace come only from clearing this karmic debt.

Sant Rampal Ji Maharaj explains that the only path to permanent freedom is salvation (Moksh), which can be achieved through the true worship of Supreme God Kabir. This is the ultimate “refund”—a return to Satlok, a place free from every type of suffering. Kabir Saheb has stated:

Manush janam paye kar jo nahi rate Hari Naam |

Jaise kuua jal bina fir banwaya kya kaam ||

The Way to Permanent Peace

Learn about the purpose of human life, the law of karma, and the path that leads to complete spiritual security.

Seek the true spiritual knowledge shared by Jagatguru Tatvdarshi Sant Rampal Ji Maharaj.

- Website: www.jagatgururampalji.org

- YouTube: Sant Rampal Ji Maharaj

- Facebook: Spiritual Leader Saint Rampal Ji

- X (Twitter): @SaintRampalJiM